Key points

- The Government now expects the Federal budget deficit to peak at $161bn this financial year (down from $214bn in October’s Budget) and fall to $107bn in 2021-22.

- The windfall to the budget from stronger growth is being spent on extra stimulus. Return to budget surplus looks more than a decade away.

- Key measures include more spending on aged care, childcare, infrastructure, investment tax breaks and more help for home buyers.

- Avoiding fiscal austerity and focussing on growing the economy is the right thing to do at present.

Introduction

The 2021-22 Budget sees the Government ditch its plan to start budget repair (or austerity) once unemployment is “comfortably below 6%” in favour of continuing to focus on growing the economy to drive full employment and, in doing so, repair the budget that way. As a result, the Budget provides more stimulus and, thanks to the stronger economic recovery and high iron ore prices, is still able to report a declining deficit. This may seem like having your cake and eating it too – but it was also a feature of the budgets in the pre-GFC years and makes sense as reverting to austerity would delay the return to full employment and decent wages growth.

Policy stimulus

The key Budget measures are:

- $17.7bn in aged care spending over 5 years;

- an extra $1.7bn over four years on child-care subsidies;

- more spending on disability, mental health & preschools;

- $15bn added to the $110bn 10-year infrastructure program;

- $1.2bn to support the digital economy;

- measures to help boost women’s economic security including removing the $450 per month super threshold;

- more assistance for home buyers via deposit schemes with a Family Home Guarantee to help 10,000 single parents buy their own home with just a 2% deposit, another 10,000 places under the New Home Guarantee in addition to the next 10,000 in the First Home Loan Deposit Scheme which allow first home buyers to get it in with a 5% deposit;

- the maximum amount of voluntary contributions under the First Home Super Saver Scheme that can be released is increased from $30,000 to $50,000;

- the age at which people can downsize their family home and contribute $300,000 to their super will be reduced to 60 from 65 and the work test for super contributions is abolished;

- an extension of the Low and Middle Income Tax Offset (LMITO) to cover the next financial year; and

- instant expensing for business investment & ability to offset losses against prior profits extended to 30 June 2023.

Total direct stimulus to the economy since pre-covid (both spent and projected to be spent) is now around $350bn.

Economic assumptions

Reflecting the faster recovery, the Government has revised up its growth forecasts with 2021-22 GDP growth forecast to be 4.25% (up from 3.5% in MYEFO) and unemployment falling to 4.75% by June 2023 (down from 6%). Inflation and wages forecasts have also been revised up a bit. We (and the RBA) are a bit more optimistic on growth. The hit to immigration (estimated to be -97,000 persons in 2020-21 and -77,000 in 2021-22 before +75,000 in 2022-23 and a gradual recovery to normal at +235,000 by 2024-25) remains a big constraint on medium term growth. Population growth this financial year will be just 0.1%, the lowest since 1917. The Government pushed out its $US55/tonne iron ore price assumption again to now March quarter 2022. With the iron ore now over $US200/tonne this remains a source of upside for budget revenue.

| Economic assumptions | |||||

| 2020-21 | 2021-22 | 2022-23 | 2023-24 | ||

| Real GDP | Govt | 1.25 | 4.25 | 2.5 | 2.25 |

| % year | AMP | 1.1 | 5.0 | 3.0 | 2.5 |

| Inflation | Govt | 3.5 | 1.75 | 2.25 | 2.5 |

| % to June | AMP | 3.7 | 1.7 | 2.0 | 2.25 |

| Wages, %yr | Govt | 1.25 | 1.5 | 2.25 | 2.5 |

| AMP | 1.5 | 2.0 | 2.5 | 3.0 | |

| Unemp Rate | Govt | 5.5 | 5.0 | 4.75 | 4.5 |

| % June | AMP | 5.25 | 4.75 | 4.5 | 4.25 |

Source: Australian Treasury, AMP Capital

Budget deficit projections

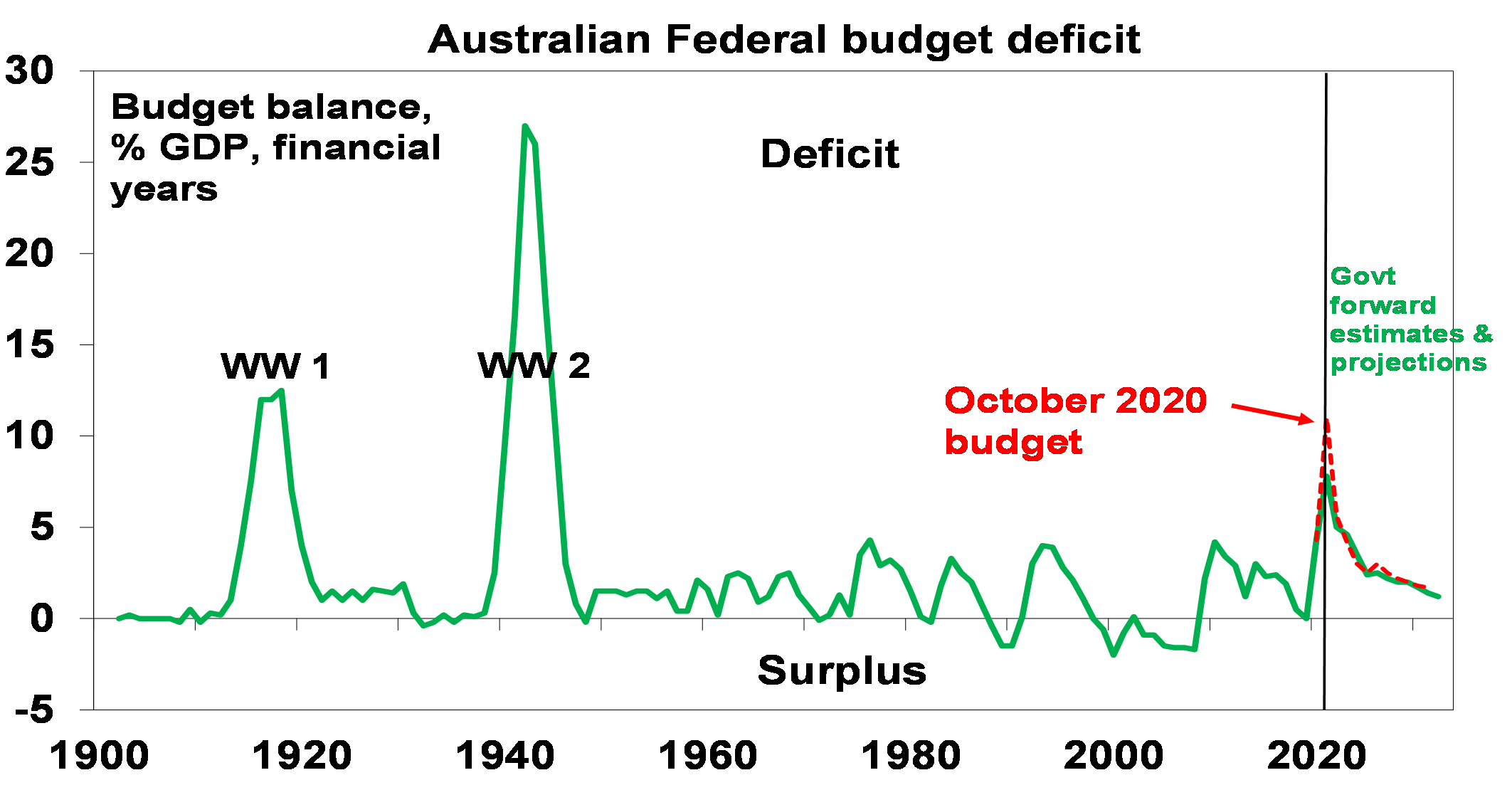

The Government’s revised budget projections are shown in the next table. The boost to revenue and savings in spending from the faster than expected economic rebound, alongside higher iron ore prices, is estimated to have reduced the budget deficit since the Mid-Year Economic and Fiscal Outlook last December by $40bn for this financial year with smaller improvements in future years (see the line called “parameter changes”). The 2020-21 budget deficit will still be the biggest as a share of GDP since 1946, but at 7.8% of GDP at least it’s well down from the 11% projected in last October’s budget. New stimulus measures since MYEFO are shown in the line labelled “New stimulus”. It amounts to $18bn in 2021-22 rising to $29bn by 2023-24. As a result of the extra stimulus more than outweighing the windfall from the stronger economy the budget deficit profile for the next four years is on balance a bit worse than previously projected although the trend is still down.

| Underlying cash budget balance projections | |||||

| 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | |

| 2020-21 Budget, $bn | -213.7 | -112.0 | -87.9 | -66.9 | -57.5 |

| 202-21 MYEFO, $bn | -197.7 | -108.5 | -84.4 | -66.0 | -55.2 |

| Parameter chgs, $bn | +40.1 | +20.1 | +9.9 | +15.8 | +18.4 |

| New stimulus, $bn | -3.3 | -18.2 | -24.8 | -29.3 | -20.2 |

| Project budget, bn | -161.0 | -106.6 | -99.3 | -79.5 | -57.0 |

| % GDP | -7.8 | -5.0 | -4.6 | -3.5 | -2.4 |

Source: Australian Treasury, AMP Capital

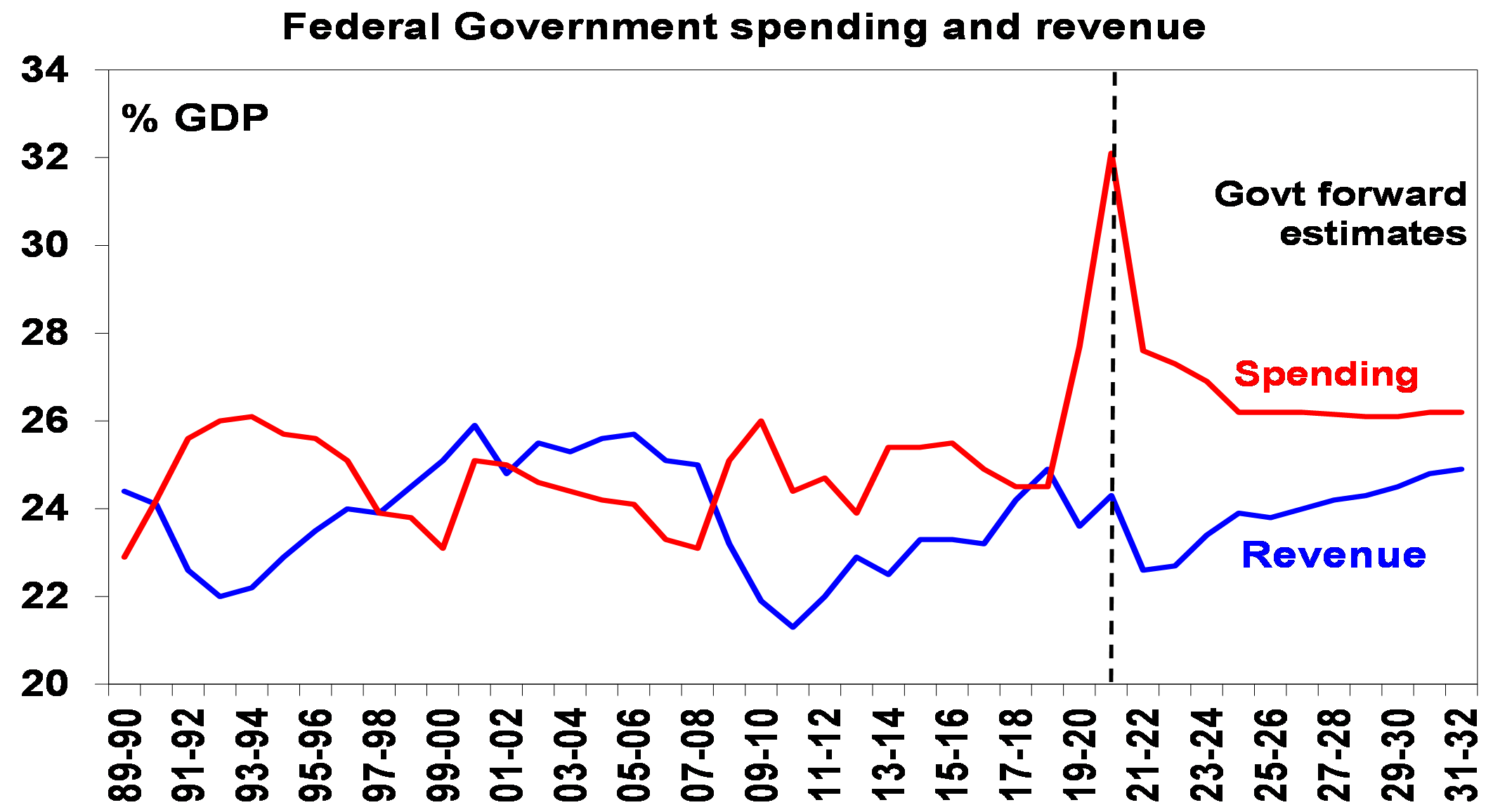

Over the forward estimates to 2025 the deficit is still projected to fall rapidly as support programs phase down & the economy expands. This will see spending as a share of GDP fall from 32% this financial year to 28% next financial year. This has mostly already happened with the end of JobKeeper in March.

Source: Australian Treasury, AMP Capital

The Government is not expecting a return to surplus in the next decade – and given the commitment to cap tax revenue at 23.9% this is likely to require spending cuts at some point.

Source: RBA, Australian Treasury, AMP Capital

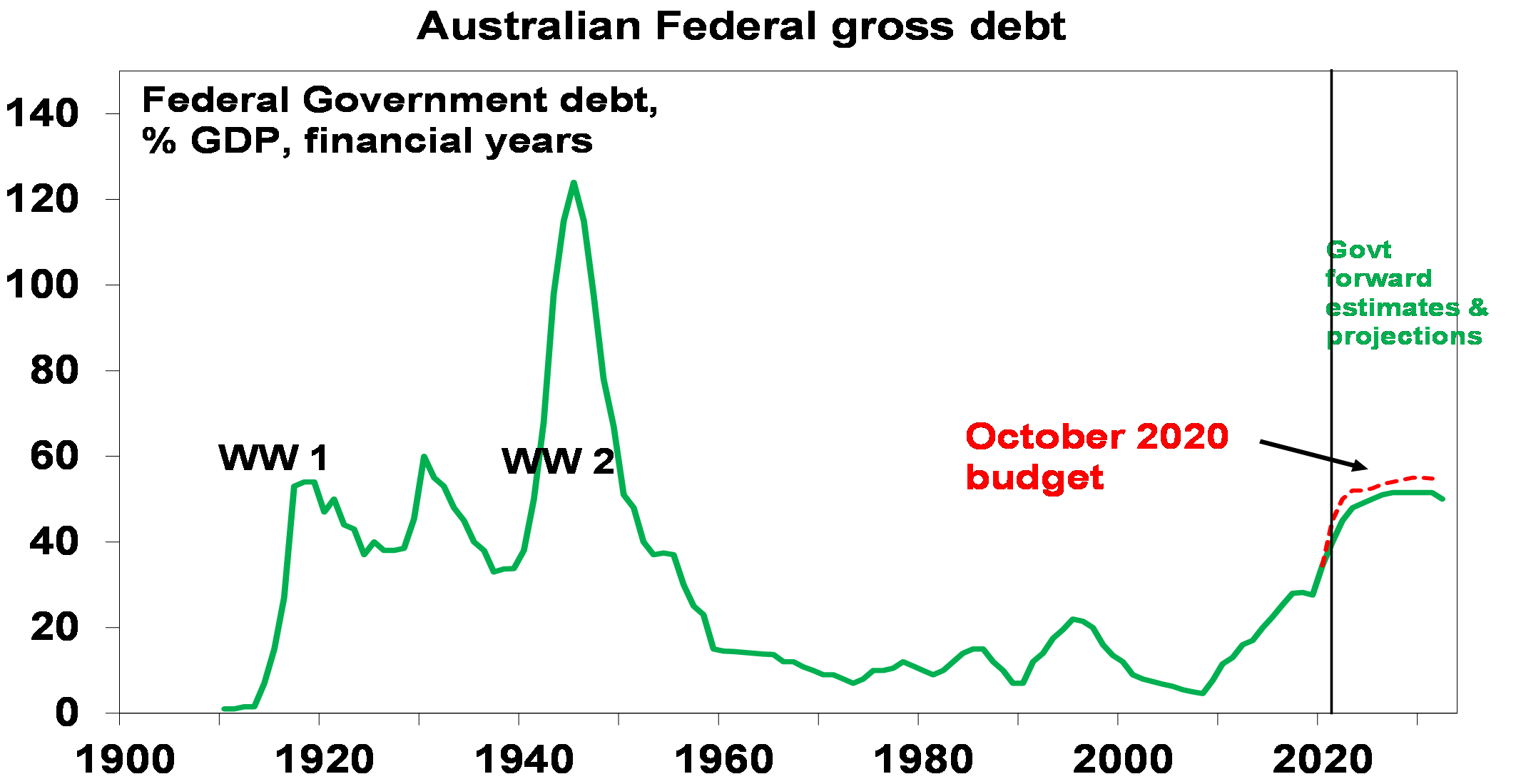

Gross public debt as a share of GDP – which is at its highest since the early 1950s – is expected to stabilise later this decade at a slightly lower level than previously expected. Gross public debt is expected to reach $1tn by 2023 and $1.5trn by 2030.

Source: RBA, Australian Treasury, AMP Capital

Economic growth will help ease the debt burden but – in the absence of a post-WW2 style population and immigration boom – it’s unlikely to be anywhere near enough to achieve anything like the rapid post-WW2 decline seen in the debt to GDP ratio.

Assessment

At a micro level the Budget may be criticised on the grounds that: more money is likely still needed for aged care and childcare; the extra infrastructure spending is still not enough; there is not a lot of productivity enhancing reforms; and the housing measures continue to focus more on boosting demand rather than supply which will result in higher prices & more debt. In terms of housing, a preferable approach would be to focus far more on boosting supply and to take advantage of the opportunities provided by the work from home phenomenon to encourage more to move to more affordable regions while at the same time making sure increased regional demand is matched by more supply. Reducing some of the buying power of investors by reducing the capital gains tax discount (not likely!) could also help free up space for first home buyer and single parent incentives.

But at a macro level it’s hard to fault the Government’s overall strategy since the pandemic began. Our assessment remains that the blow out in the budget deficit to support the economy through the pandemic was necessary and we are now seeing the benefit of the Government’s strategy in that its enabling the economy and jobs to rebound far faster than is normally the case after recessions. This, in turn along with windfall corporate tax revenue flowing from much higher than expected iron ore prices, is helping to improve the budget deficit (and we suspect will do so at a faster rate than the Government is projecting). It’s also worth noting that Australia’s level of net debt remains low compared to other developed countries. While bond yields have increased, debt interest costs remain very low making high debt more sustainable and most of the support programs were temporary and targeted and so, are rightly ending as the need for them declines. In terms of the latter, it made sense for JobKeeper to end as the jobs market has recovered, and its ending does not appear to have caused a major problem.

Likewise, it makes sense for the Government to remain focussed on growing the economy. We are still a long way from full employment, which could be at a 4% unemployment rate or below, particularly when high underemployment is allowed for.Reverting quickly to fiscal austerity would just put all the pressure back on the RBA at a time when it has few levers to pull – and delay the return to full employment and decent wages growth. Which would risk heightened social tensions.

There are few direct losers in this Budget and many winners – including aged care recipients, parents, business, low and middle income earners, women, downsizers, first home buyers, single parents, older super members, builders, etc.

Implications for Australian assets

Cash and term deposits – with the cash rate likely remain at 0.1%, cash & bank deposit returns will stay low for a long time.

Bonds – still low bond yields combined with a rising trend in yields as the economy recovers resulting in capital loss mean that medium-term bond returns are likely to be low.

Shares – ongoing fiscal stimulus, strong growth and low rates all remain supportive of Australian shares, notwithstanding the high risk of a short-term correction.

Property – more home buyer incentives along with low rates & economic recovery will likely see house prices rise further this year and next although the pace of increase is likely to slow.

The $A – ongoing fiscal stimulus, rising commodity prices and a declining $US point to more upside for the $A.

Dr Shane Oliver – Head of Investment Strategy and Economics and Chief Economist, AMP Capital

12 May 2021